By Jamie Atkinson, Undergraduate Economics Research

Times have never been economically tougher for Venezuelans, be that uncontrollable hyperinflation, economic inactivity or fleeing workforce. This has been compounded by US sanctions to over-rule the current standing – in many ways corrupt – government, and its political stance, that has led in part to this economic disaster.

Recent article titles regularly use phrases regarding crisis and catastrophe and discuss frequently how Venezuela’s collapse has become the ‘worst outside of war in decades’. Why might this Latin American nation be in so much trouble and what does the future hold for Venezuelans, who by all accounts, are deserting their own country?

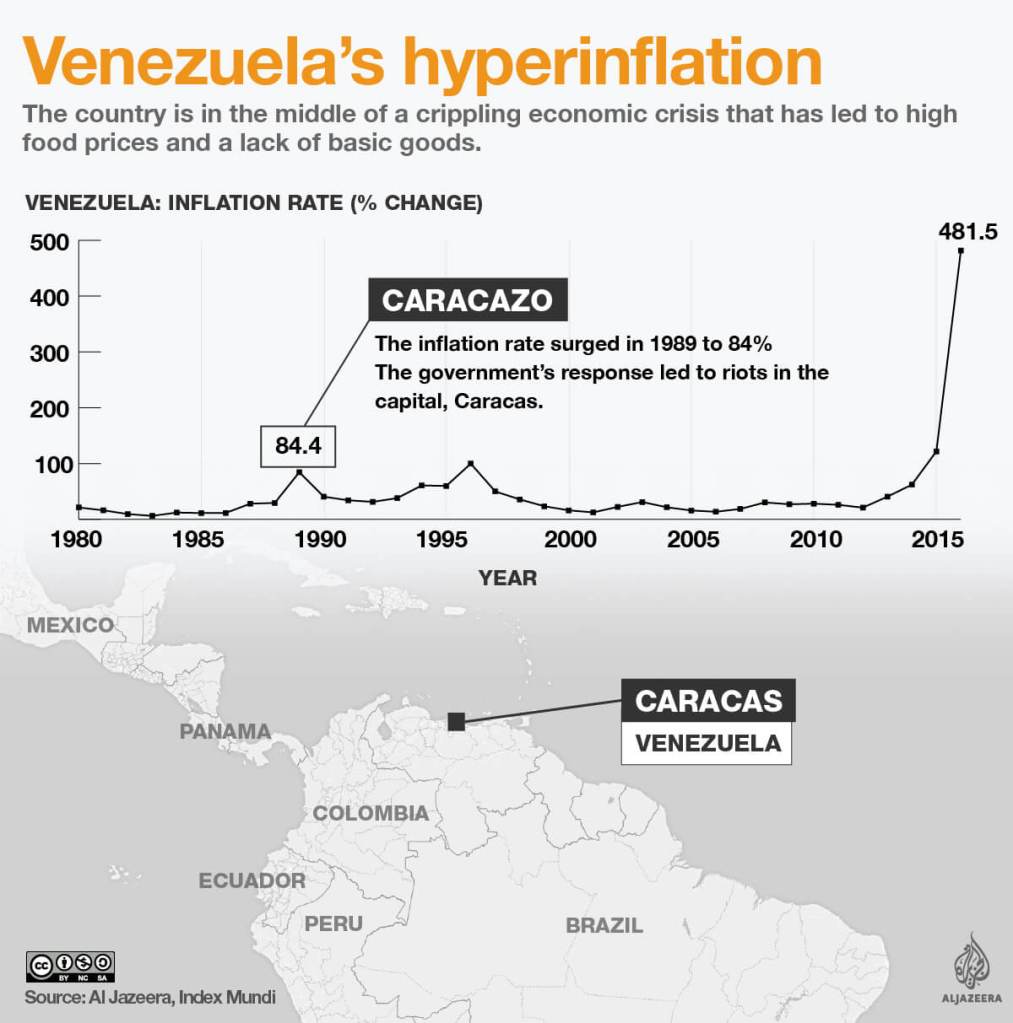

Firstly, one might look to Venezuela’s economic history. A largely petroleum exporting nation, Venezuela is very resource endowed and has long relied on this fact to survive. It is no surprise that its economic downturn has coincided with a negative deviation in crude petroleum output. However, it is its currency which is most highly flawed. In the last four years especially, inflation levels have had markedly vast and destructive effects on the native currency and in 2015 alone hyperinflation hit over 400%, seen in this tabulation. This would go on to be a standard, if not small inflation rate relative to other huge rates in the thousands and millions which were seen.

Hyperinflation refers to a state of inflation at a vast rate and is always an indicator of an economy doing badly. In the last few years, inflation has meant that normal shopping items have demanded millions or even billions of the denominated currency which is the Venezuelan Bolivar. It is this issue which has led to chaos in the economy and has drowned the currency compared to other Latin American nations.

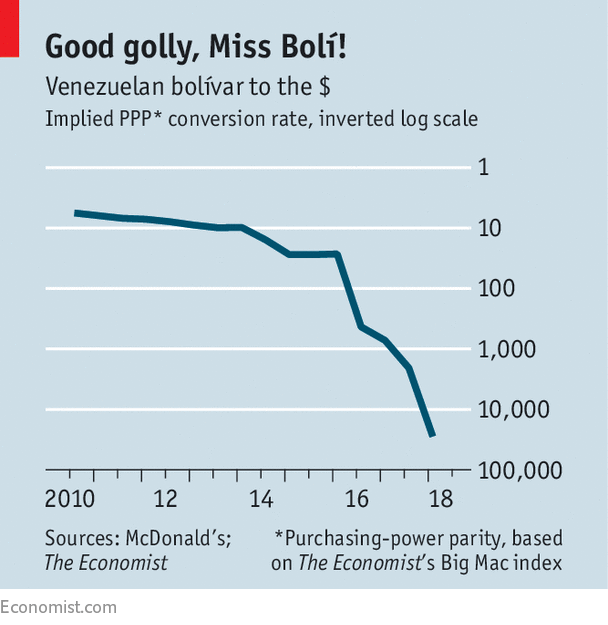

Why hyperinflation? Why a financial crisis? Heavy money-printing and deficit spending in short! These policies have clashed largely with Venezuela’s insistent demand of pegging its currency against others, with the Bolivar being recently pegged to its own crypto currency called “Petro”. It Is therefore the case that Venezuela has suffered what’s known as a first-generation currency crisis. In fact, itself and other Latin American countries have suffered economic difficulty of this nature for over three decades. A first “gen” currency crisis is where a nation is attacked speculatively because of a discrepancy between government and monetary policies and a fixed exchange rate. In the main, economic agents have abandoned Venezuela and the Bolivar because of its inability to soak the currency up due to short central bank reserves and a suspected depreciation has led to an actual devaluation of its currency. A devaluation is when one currency – a ‘home’ currency – is worth less in terms of another ‘foreign’ currency. The Maduro government has even enacted new currencies along the way by redenominating and has previously knocked 5 zeros off of the Bolivar. Most recently in 2018, the new Bolivar came into circulation to take over from the proceeding Bolivar Fuerte.

The Bolivar has supposedly lost 99.9% of its value in two years and the below graph aptly shows the sharp decline in its value compared to the US Dollar.

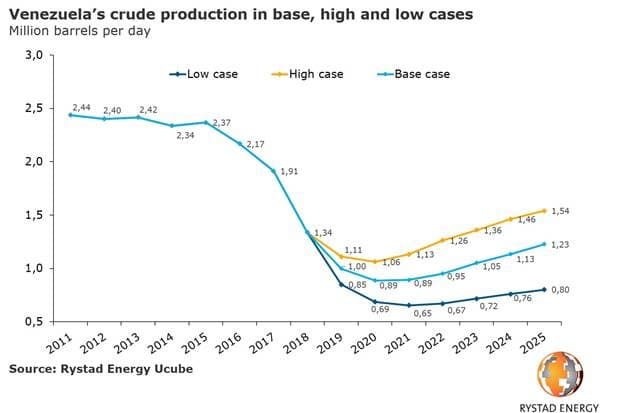

This has had a drastic effect on capital movement and in fact has led to huge levels of capital outflow. More importantly however it has led to a large outflow of human capital as people migrate to other neighbouring countries for better lives. This has meant that production of exports have fallen vastly, namely crude oil production and similarly damaging were the US sanctions and penalties.

This graph shows how production volumes have fallen through the floor.

Bearing in mind, Venezuela relies on crude petroleum trade as 80% of its export volumes, we can say with relative assurance, that Venezuela is in trouble. As we can see, predictions point to an uptick in production after this year, however it is estimated that this will be a slow recovery.

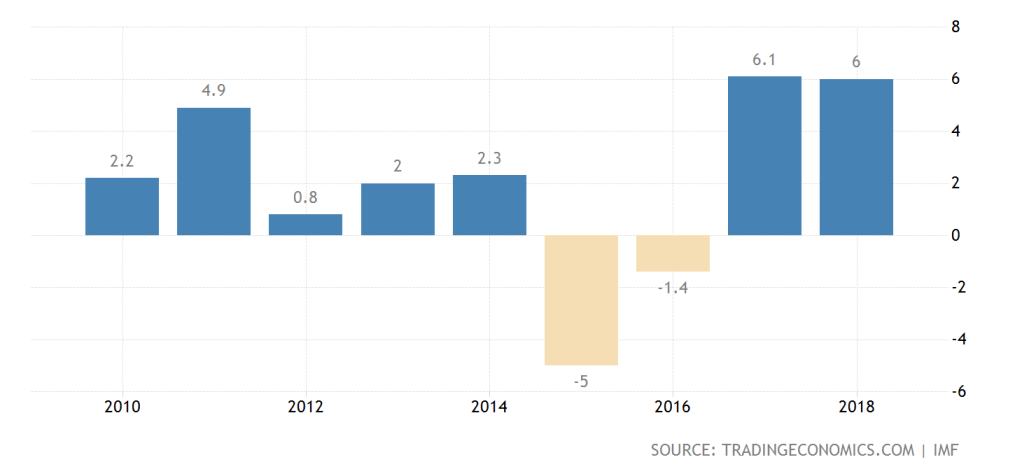

Since 2016 when the crisis deepened further, there has been a change to a current account surplus which can be seen in the graph showing the Venezuela Current Account to GDP. It is likely that other nation’s current accounts will change as their trade balance differs as a result in this fall in production of oil.

What are the real word implications of the situation in Venezuela?

People are unable to afford food in some instances because of the vast hyperinflation and as mentioned have fled the country to source better livelihoods and more poignantly better lives. Worryingly, Venezuela relies heavily on petroleum revenues to fund its import volumes, which it needs for practically everything. It is therefore no use to Venezuela to have a better current account balance as it needs the imports as a matter of importance.

What remains to be seen is whether the value of the current Bolivar is sustained or not? By all accounts, it is still on a downward trajectory. More and more, regular shopping items are costing more and more Bolivars, even to the point that morning shopping is cheaper than shopping in the evening. Depreciation pressure on the Bolivar has well and truly been felt and the devaluation seen is one of the worst in history.

Can the Bolivar become anymore worthless?…